In this blog post, we dispel the myth that only large companies can implement fully integrated planning with modern CPM and BI technology in their businesses. It’s true that we often hear about large, well-resourced companies being held up as role models for awards and accolades, and their perfect digitization concepts being paraded through the media. But that doesn’t mean small and midsize businesses can’t do just as well. In fact, in our experience, they can do it better because their organizational structures are not as complex, allowing for quick and straightforward decision-making.

We want to explore whether the requirements for businesses of different sizes are different and what finance departments hope to achieve from digitalization with performance management and BI tools. We’ll also conclude with some practical implementation examples and showcase success stories from both large and small companies.

Let's start with some success stories and how they came about:

- Reduced reporting times: Reporting now takes just one day instead of 8 days. Reports are accurate, readily available, easy to understand, and tailored to user roles.

- Planning cycles have been reduced from 4 months to 6 weeks, and continuous rolling planning is possible, leading to process improvements.

- Three full-time equivalents (FTEs) have been freed up for value-added, decision-supporting tasks.

- € 450,000 in savings through efficient project controlling.

How does that sound? Good? We think so too. What’s even better is that these improvements represent real achievements, realized by our clients in joint projects. But how do you achieve this? Work faster or sacrifice quality? “Quick and dirty” or thorough and slow? We believe in neither! We believe in thorough and fast. It can be done using the support of the right performance management and BI technology.

To what company size does the introduction of such technology make sense?

It’s not just the number of employees or revenue that determines the ideal company size for introducing such technology. Rather, it’s about whether the finance department and financial controlling are considered relevant within the company. Initially, smaller companies or startups may lack this awareness, but as they grow, the need for active financial control becomes apparent.

For instance, the rapidly growing online marketing start-up MAWAVE chose to switch to modern CPM & BI technology instead of relying on Excel. Uncertain data and analysis thereof required the company, which had “only” 89 employees at the time, to make this decision. smartPM and partner technology Unit4 FP&A collaborated to develop a startup solution that facilitated a successful implementation. The pre-filled business content provided by smartPM was vital for an organized, seamless, and rapid execution in fields such as Human Resources, Capacity Planning, Financial Planning, and Project Planning.

Next, let’s explore whether there are distinctions in reporting, planning, analysis, forecasting, and budgeting needs between small, medium, and large corporations.

Do companies of all sizes have similar desires from digitalization in the finance department?

We work with clients of varying scales and across diverse sectors, and we observe consistent expectations towards digitalization:

- Simplicity: optimized and organized processes and systems, intuitive interfaces.

- Flexibility: adaptability of the system to changing market conditions and specific company requirements, including the time interval for rolling forecasts, ranges, global orientation, or system adaptability to cover ESG/sustainability control, regulatory changes, and related aspects.

- Integration of all data to ensure consistency from strategy to operational execution.

- Efficiency gains through automation and standardization. Frustrating, manual, repetitive tasks are no longer necessary in the digital age.

- Effective governance and the sensible use of AI.

- Continuous monitoring and optimization of measures, KPIs, planning.

- Agile organizational and competency development, process optimization, mindset building are all crucial.

- Seamless collaboration through the integration of communication tools.

- Decision support through modern methods such as scenario analysis, continuous rolling planning, driver value analysis, initiative tracking, etc.

- Involving multiple or all company departments – up to xP&A (extended planning & analysis = fully integrated corporate planning).

Learn more about FP&A success stories on the smartPM knowledge platform with references, case studies and video content.

If the requirements are the same, does that mean any technology will suffice?

The appropriate technology for implementing modern, efficient planning, analysis, forecasting, and reporting often depends on several factors, including:

- The preferences of decision-makers within the company.

- The degree to which the tools meet the requirements.

- The budget for digitalization in controlling and the number of (power) users.

Determining the most suitable technology for a company, such as MS Power BI, Unit4 FP&A, Jedox, or SAP, can often be quickly achieved by conducting a thorough analysis of process requirements. Certain technologies are better suited for smaller or medium-sized businesses, while others are more appropriate for larger enterprises, depending on their architecture.

SAP SAC for planning is commonly the software of choice for planning among large, global organizations. Medium-sized companies with both national and international operations often select Jedox or Unit4 FP&A for its flexibility.

For smaller companies, planning functionality offered by MS Power BI often takes priority. However, fast-growing startups, like Go-Student or Mawave, typically prefer highly flexible and scalable software with a future-oriented focus. Another example is List GC, an owner-operated company that provides exclusive yacht and apartment outfitting services. Previously relying on Excel, the medium-sized company became exhausted from troubleshooting formulas. Consequently, they opted for technology and implementation from a single source. Following the implementation of the new financial and project planning, the project-driven company accomplished yearly savings of € 450,000 and substantial quality improvements. Obtain additional information on the List GC case study here.

Determining the appropriate technologies and tools for particular use cases is best discussed in a professional setting. Skilled implementation and consulting teams possess extensive knowledge of the software products and can offer guidance drawn from their project experience.

Five critical success factors should be taken into account, beyond selecting the correct technology

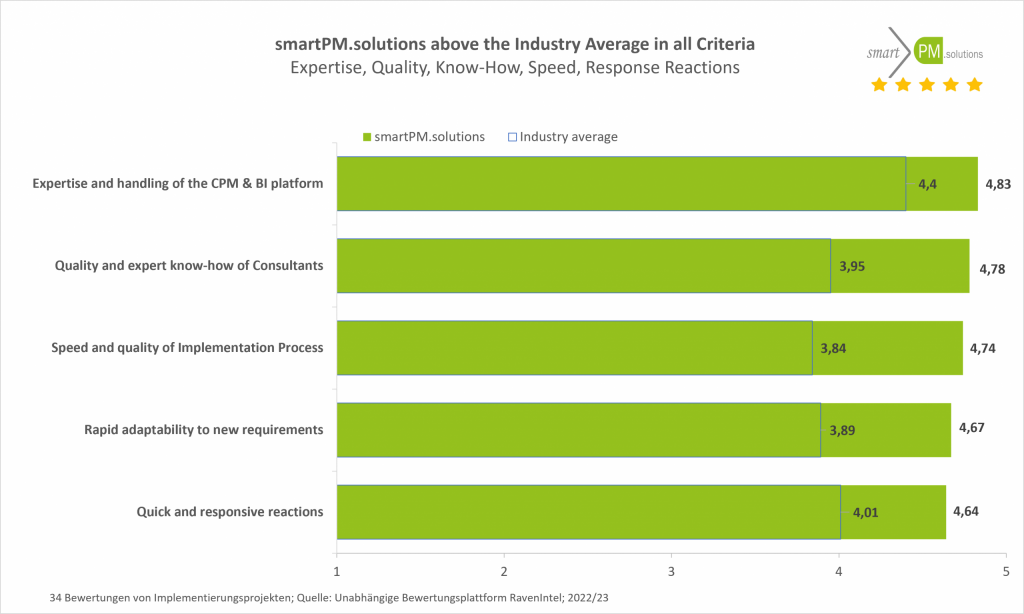

Experience from hundreds of projects indicates that integrating appropriate technology with expert consultation generates the highest user expertise, shortest implementation period, and greatest system contentment. Additionally, professional assistance to users following implementation is essential (support service levels).

The 5 critical success factors for implementing digitalization in the finance department are as follows:

- Determine the specific requirements for FP&A and BI technology, both currently and in the future.

- Obtain internal support, particularly from management and IT, and allocate the budget.

- Clearly communicate the benefits.

- Carefully choose the implementation team based on expertise, project experience, reliability, accessibility, and customer satisfaction.

- Plan the steps after implementation – rely on professional support in your preferred language while keeping the possibility of expanding your system.

For example, the 5-step plan created by the finance team at the internationally operating tech provider ROSEN Group proved highly effective. “The implementation and support team outweights the technology,” ranked as the most important criterion for the implementation of xP&A, “as the technologies are quite similar and vary only slightly in details,” revealed Daniel Olthaus, Head of Analytics at the ROSEN Group.

Do you need guidance on selecting the appropriate technology and want to view examples of successful implementation? Feel free to select a convenient meeting time in our online calendar: